Datarius The first social decentralized cryptobank

As a P2P platform, the system enables users to decide themselves whether to use any of variable services and applications. This in turn allows to almost completely reduce transaction costs. Datarius serves as a direct link between lenders, borrowers, and the related services – managers, analysts, insurance companies, funds, trading terminals.

About Datarius

Fintech company iCrypto S.A., developing Datarius Cryptobank, is at the forefront of new digital economy. The Datarius project is a new, social-type cryptobank with transparent conditions. In cryptobanking industry, Datarius will become the first financial institution capable offering its customers a full range of financial services implemented within a decentralized system.

The uniqueness of Datarius Cryptobank is that the project allows customers to get services, adapted to their needs. Datarius will operate on the basis of P2P ecosystem (peer-to-peer), where transaction participants are private users, and not banking institutions. This is not a novelty in the financial market, but system offered by Datarius inherited best traits from traditional banking products, adapting them to the principles of decentralized system operation. Such platform will be a perfect solution for people without credit history, to whom traditional banks cannot provide loan proposals, or for whom current offers on the market will cost much more.

The Datarius project has a global value. It is designed to overcome current diffculties connected to use of cryptocurrencies in non-digital world, introducing options of integrated crypto- and fiat money services into payment infrastructure for this purpose.

Primary mission of Datarius cryptobank is creation of P2P-system that would make use of full potential of decentralized financial technology within the framework of cryptocurrency payment system and real life.

Another substantial part of Datarius mission is to provide world community with access to major financial instruments in P2P transaction format. In relatively short time cryptobank clients will receive services that ultimately meet their needs, because transactions will be conducted in automatic mode, while services will be customizable. Any transaction will be much more profitable since P2P-platform does not split loan and deposit products and does not involve staff dealing with this.

Unlike most developers who continue promoting monopolization of world financial market by large players, Datarius team aims to create perfect financial institution that would adopt all advantages of traditional financial organizations, leaving behind their major disadvantages: non-transparency, unpredictability, lobbyism, and administrative burden. Datarius model represents decentralized system in exceptional and most complete format. It includes blockchain technologies that ensure secure information recording and storage. This excludes the possibility of changing or falsifying any piece of data.

Usage of cryptocurrencies, which do not require central control, as well as smart contracts allows to process transactions more effciently and safely compared to conventional deals. Datarius is a decentralized partially closed system which sometimes excludes bank participation that makes it possible for users to gain profits.

The system allows users to make their own decision when judging appropriateness of certain services and applications, which minimizes cost of processing transactions. Customer selects a service according to his/her own requirements and pays the price without customer service charge.

A range of financial products is formed in particular by the DTRC token holders that are directly engaged in the development of the company through intangible contributions. The purchased tokens entitle active holders to receive 65% of the fees and charges collected by the Datarius cryptobank. The amount shall be distributed annually starting from 2019, in proportion to the number of the token holders.

DTRC TokenDTRC Token

The final number of DTRC tokens will be defined according to ITO round and will correlate to the total token supply, taking into account the final distribution according to approved structure

The fixed value of the token: 0,01$

SoftCap: $1,000,000

Hard Cap: $51,000,000

18.02.2018 Token cost: $0,01 Bonus: 6%

DTRC TOKEN PERSPECTIVES

* The outlook for the value of the token is provided for informational purposes only and reflects data from independent analysts

INITIAL TOKEN OFFERING

Stage objectives — identification and implementation of future functional and initial set of instruments of Datarius ecosystem, as well as:

- completing the team with additional personnel;

- prototype development;

- project launch;

- wide PR and marketing campaigns;

- access to exchanges;

- conclusion of key agreements with partners;

- dynamic expansion.

Token DTRC

PreICO Price 1 DTRC = 1 USD

Price 1 DTRC = 0.01 USD

Bonus Available

Bounty Available

Platform Ethereum

Accepting ETH, BTC, BCC, LTC, Fiat

Soft cap 1,000,000 USD

Hard cap 51,000,000 USD

Country Costa Rica

Whitelist/KYC KYC

The purpose of DATARIUSis is to provide free access and the equivalent of a maximum number of financial products to people all over the world. DATARIUS mission is to create a new transparent financial products. Provide customers with clear tools and more opportunities. Ensure freedom of choice and action. Delivers a high level of automation that will help overcome the classic stereotypes of systems and services and communicate with consumers. Socialize financial technology products by assessing "people" and trust limits through public comment on participants and transactions. To get rid of the unpleasant product line impression. Stand with clients and provide opportunities for active and capable participants to benefit simultaneously with the project through special functions, co-branding programs and partners. Open and transparent in all directions. DATARIUS hopes to show through its own example that decentralization and lack of restraints are the benefits that financial companies will become partners, guides, and friends.

Milestones

02.2018 The approval of the prototype TR (it’s been under development since 2017)

03.2018 the initiation of the user interface development

04.2018 the obtaining of the DPL license (Costa Rica) – payment system, asset management company, investment company (the application was sent in December 2017)

04.2018 the start of work on testing our own blockchain

05.2018 the signing of the bank support agreement and integration of co-branded IBAN/SWIFT accounts and debit cards

05.2018 launching the development of own machine learning system AI

07.2018 the completion of work on user interface integration and P2P platform organization

07.2018 embarking on the mobile application development

08.2018 the presentation of the fixed checks function

09.2018 the integration of internal exchange

09.2018 the public algorithms testing for the applications machine ranking in the testnet

10.2018 the launch of the basic version

11.2018 the presentation of training materials and introduction to the Training Center

11.2018 the integration of virtual maps

12.2018 the beginning of the social functions development (Trust Management/Trust Limits)

12.2018 the presentation of test version of mobile app to competent users

02.2019 the completion of the testing phase, the launch of the commercial version and the intensified PR campaign

02.2019 the preparation and submission of documents to obtain the license from the British financial regulatory body FCA

02.2019 the provision of confident users with the test access to social functions

03.2019 the release of the commercial version of the mobile app

03.2019 the presentation of a team of full-time professional managers

04.2019 the integration of the Affiliate Program

04.2019 the presentation of the short-term savings account function

05.2019 the presentation of the Training Center franchise and becoming a franchisor. Registration of the first franchisees

05.2019 reaching the point of 1M active users

05.2019 the first mortgage lending in DTRC

06.2019 providing access to the function of the payment calendar and deferred payments

06.2019 opening access to the examination to attain the managing user/managing analyst status

06.2019 affiliate integration of the access to the exchange terminals with instant DTRC payment

07.2019 The delivery of the first credit card

07.2019 The presentation of the Cabinet for SMEs (package payments, regular payments, sub-accounts, expenditure control, co-branded cards, prioritized applications processing, preparation of electronic reports, statistics and analytics)

07.2019 The locking from the TOP cryptocurrency exchanges through the partner trading accounts

08.2019 The presentation of cold savings accounts

08.2019 The integration and testing of the instant transfer systems

09.2019 The provision of the test access to the portfolio investment formation module

09.2019 The completion of open testing and the presentation of the first managers and analysts – users

11.2019 The integration of biometric authentication

12.2019 The presentation of the system automation commercial version based on its own AI

01.2020 The first distribution of 65% fees and charges collected in 2019.

02.2020 The integration of a private Pension Fund (most likely Jersey)

03.2020 The submission for SWIFT membership status

04.2020 The completion of the first “foot” bankers training and the program startup

05.2020 The presentation of the venture capital fund composed of the ecosystem top users and internal funding platform

07.2020 The integration of the access to investments in government bonds (developing countries)

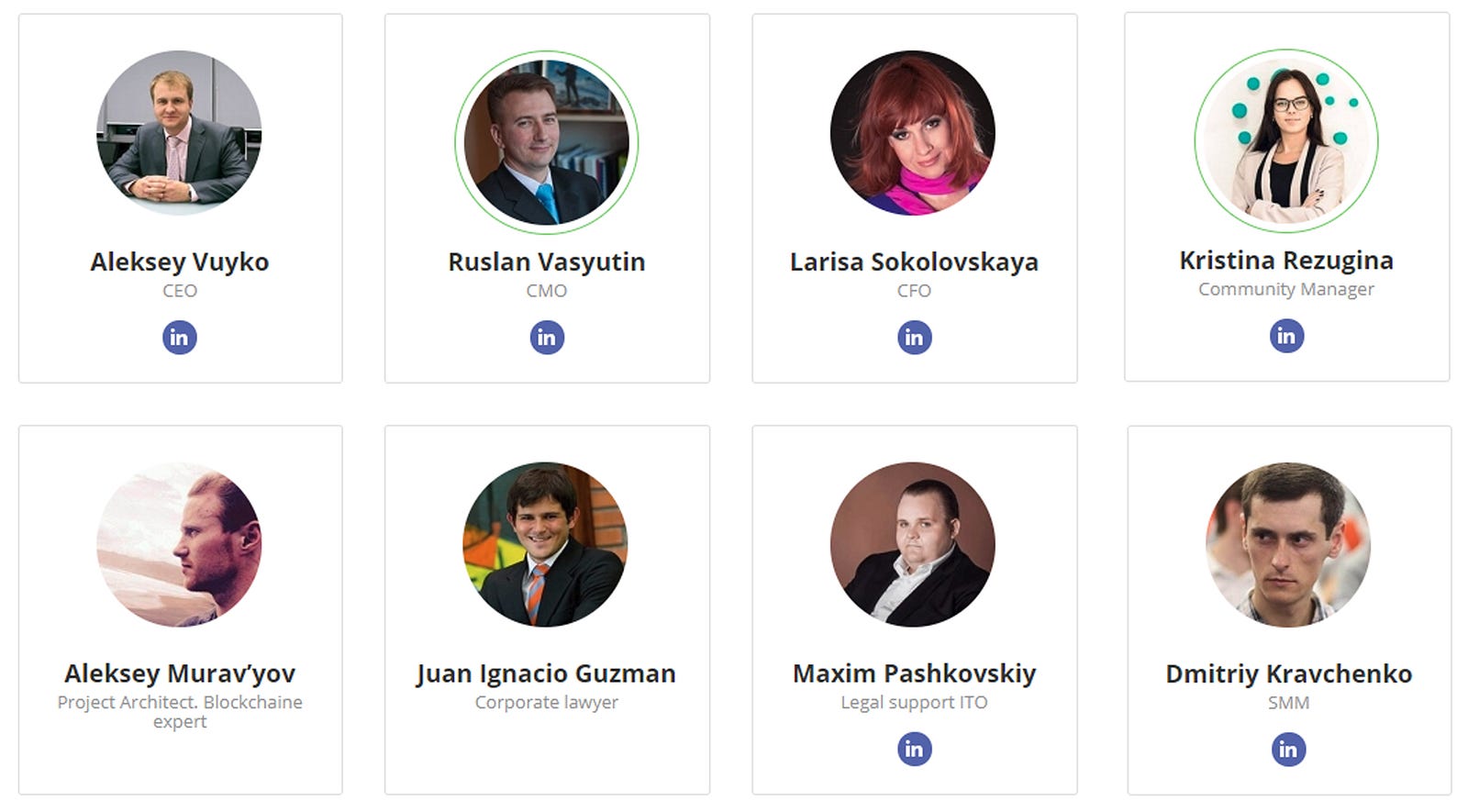

TEAM

For more Informations:

WEBSITE | FACBOOK | REDDIT | TWITTER | GITHUB | WHITEPAPER | TELEGRAM | BITCOINTALK | BOUNTY | MEDIUM

Author: sandysan

ETH: 0x022DfD639385A07a9EE272404854fE6598fEBA4b

Kommentare

Kommentar veröffentlichen